Stocks trounce bonds with double-digit gains

MAIN POINTS

Stock markets around the world rallied strongly in 2019. Returns likely to be more normal in 2020.

Bonds rallied for the first three quarters due to global and trade uncertainty, but dropped in Q4.

Election uncertianty and high optimism and risks for stocks in the first half of 2020.

A year ago, investors were worried about rising interest rates. Policymakers, like the Fed, reversed course in early 2019. By the time the year was over, the Fed had cut rates three times and added about $240 billion to liquidity.

Lower rates and some clarity around the China trade agreement drove a move to riskier assets in Q4. The S&P 500's 8.5% surge (price only) in Q4 was the best since 2013 and the 19th highest since 1928. Stocks trounced bonds. The S&P 500 gained 9.07% on a total return basis, while the Long-Term U.S. Treasury Bond Total Return Index dropped 4.12% in Q4.

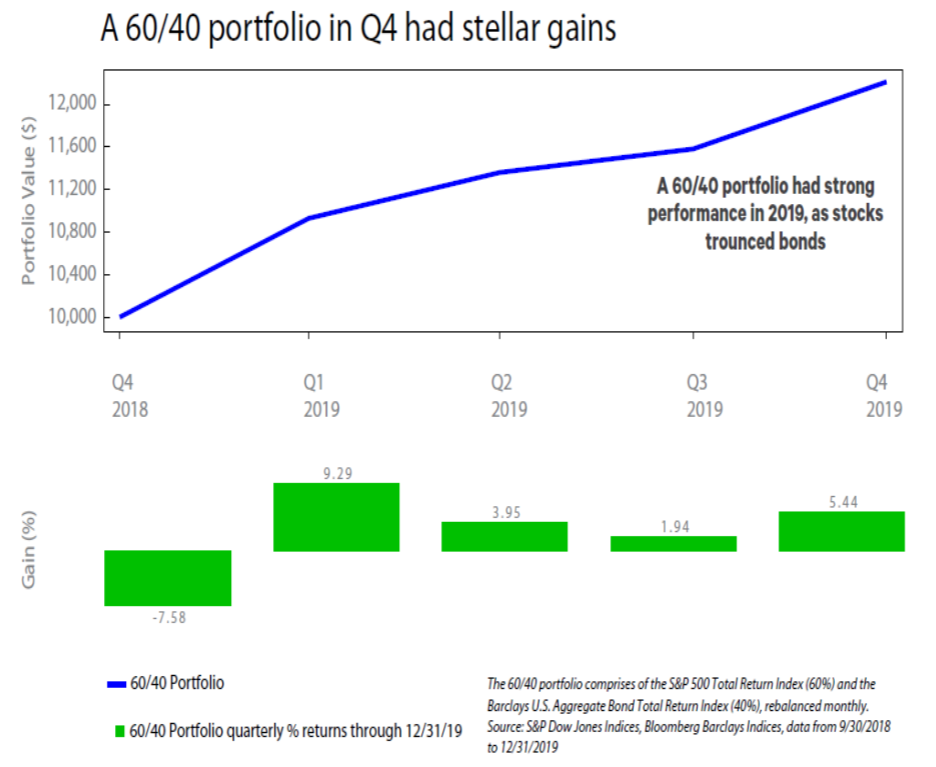

A typical 60/40 portfolio (S&P 500 Total Return/U.S. Aggregate Bond Total Return) put in a strong performance for the quarter at 5.44% (chart below).

The Nasdaq Composite Index was the top U.S. equity benchmark. Led by the tech sector, the Nasdaq surged 35.2% in 2019, including a 12.2% gain in Q4. Growth beat Value across all three cap tiers in Q4 and for all of 2019. The strongest gains were within large-caps. The Russell Top 200 Growth beat the Top 200 Value by 3.33% in Q4.

Technology and Health care both surged over 13% in Q4, leading all sectors. The U.S. outperformed developed international stocks, while emerging markets kept pace in Q4. In contrast to last year, most commodities gained. Oil prices were up 30%, and gold finished up 18.77% for the year.

2020 Outlook

Stock gains likely to outpace bonds

There are four cycles that are near critical junctures: economic; earnings, Fed, and election. Whether they align with or counteract each other should determine how 2020 unfolds.

The U.S. economy will likely slow but avoid a recession. Earnings growth should accelerate modestly to about 6%. If the Fed stops at three cuts, by the second half of 2020, much of the liquidity will have worked its way through the system. So, a risk for 2020 is that monetary policy shifts from being a tailwind to a headwind in the second half. An additional risk is the typical path of the market during election years.

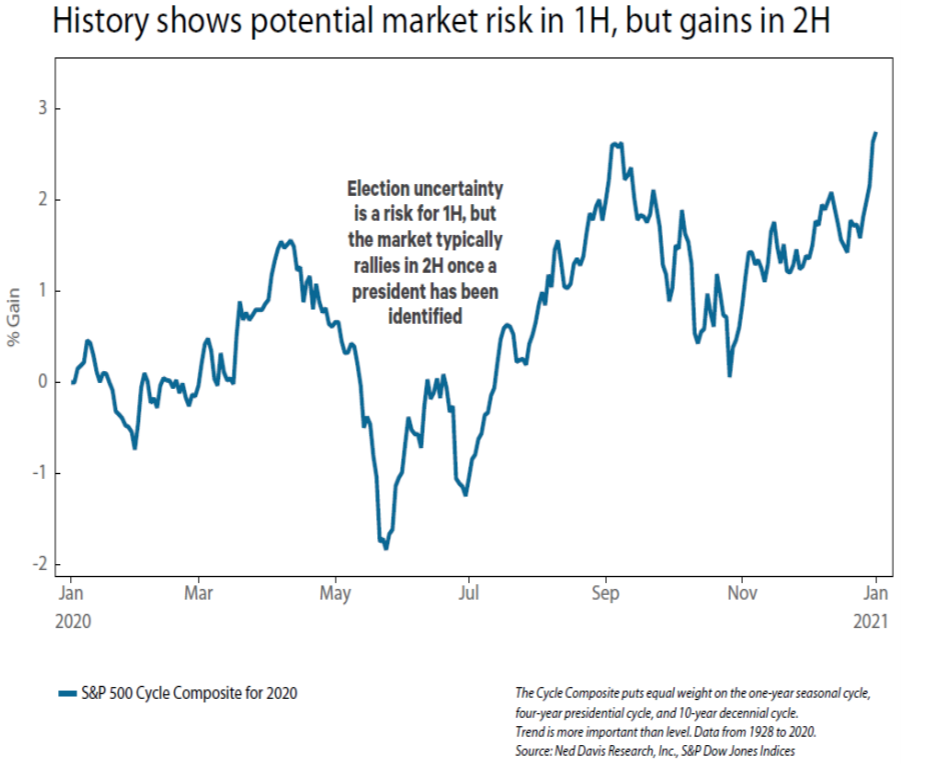

According to Ned Davis Research, the S&P 500 2020 Cycle Composite is weak in the first half (chart right), primarily due to the four-year presidential cycle. While the stock market typically rallies in the second half, it struggles when the incumbent party has lost. The market hates uncertainty, and a new president brings unknowns.

Another risk is that investor sentiment is optimistic. The market is vulnerable to the next piece of bad news - no matter what it is.

Rising rates could continue to pressure bond proxy sectors, like Utilities, in early 2020.