Walking an Economic Tightrope

The Federal Open Market Committee (FOMC) consists of 12 members: the seven members of the Board of Governors of the Federal Reserve System; the president of the Federal Reserve Bank of New York; and four of the remaining eleven Reserve Bank presidents, who serve one-year terms on a rotating basis. A major part of this committee's job is to review economic data & discuss their outlooks in order to establish monetary policy. The challenge they will have in 2025 is how to balance the fight against stubborn inflation against the desire to maintain low unemployment. Below are 4 graphs explaining their outlook, taken from the December 2024 Summary of Economic Projections.

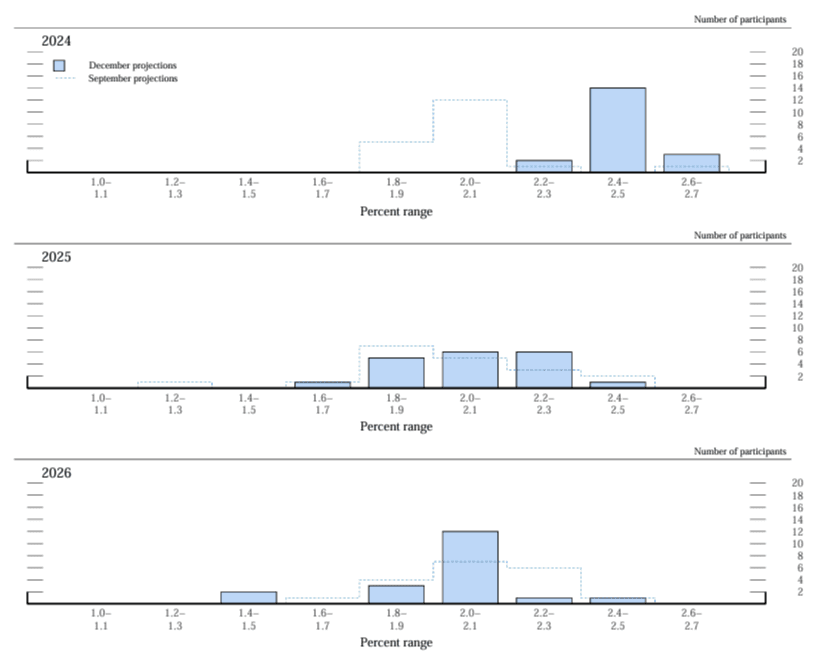

GDP Growth

The FOMC projects real GDP growth to average 2.1% in 2025, down from 2.5% in 2024. The committee expects growth to slow in the first half of 2025, followed by a modest pickup in the second half of the year.

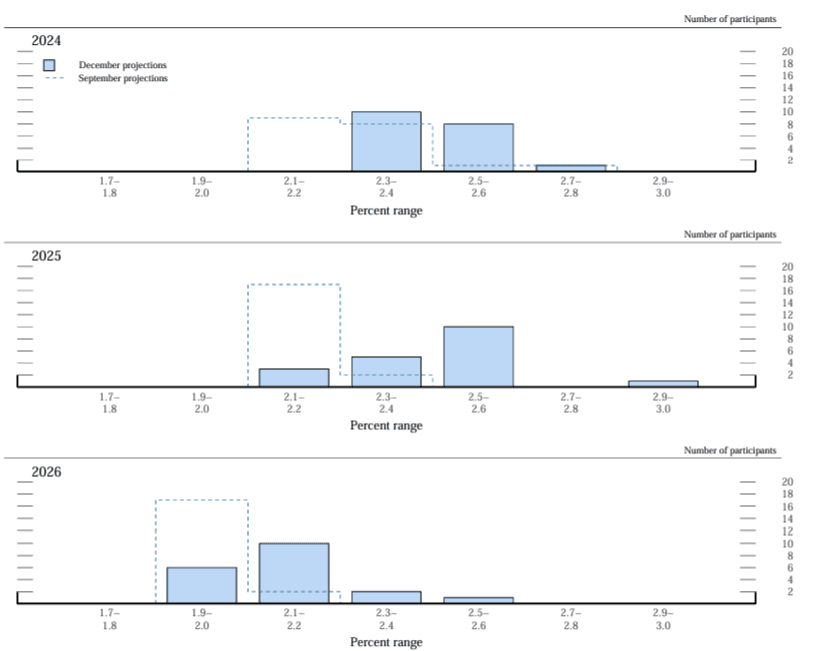

Inflation

The FOMC forecasts the personal consumption expenditures (PCE) price index, their preferred inflation measure, to rise to 2.5% in 2025, up from 2.4% in 2024. The committee expects inflation to remain above its 2% target through the first half of 2025, before gradually declining.

In addition to the FOMC analysis, we also should consider the potential o=impact of the new administration's fiscal policy regarding tariffs. On one hand, it could be argued that the positions could be used simply to establish a bargaining position. On the other hand, if they were to be implemented as they have been described so far, they could lead to even higher inflation as either the additional cost due to tariffs would be passed on to US consumers, or because domestic producers might have higher labor costs than overseas producers.

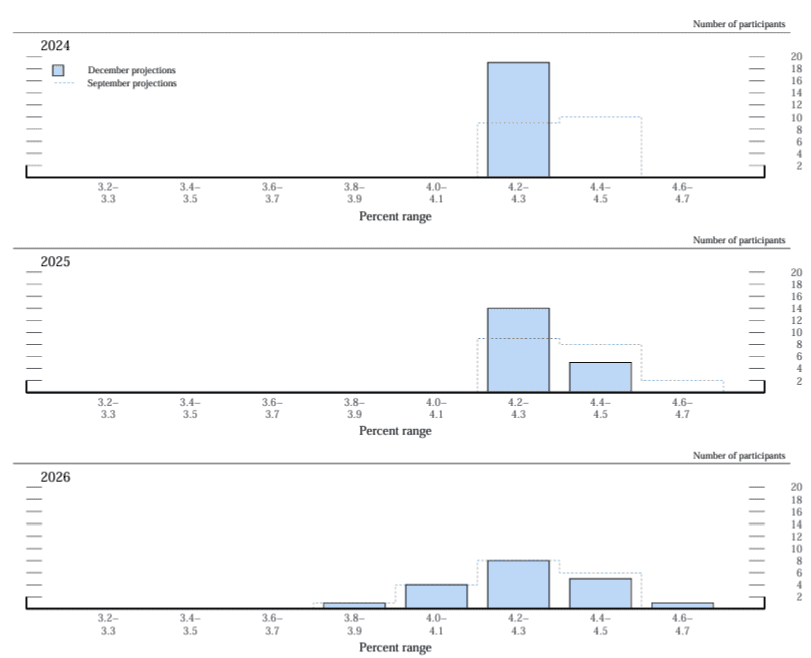

Unemployment

The FOMC projects the median unemployment rate to increase to 4.3% in 2025, up from 4.2% in 2024. The committee expects the labor market to remain strong, with a relatively low unemployment rate, from a historical perspective.

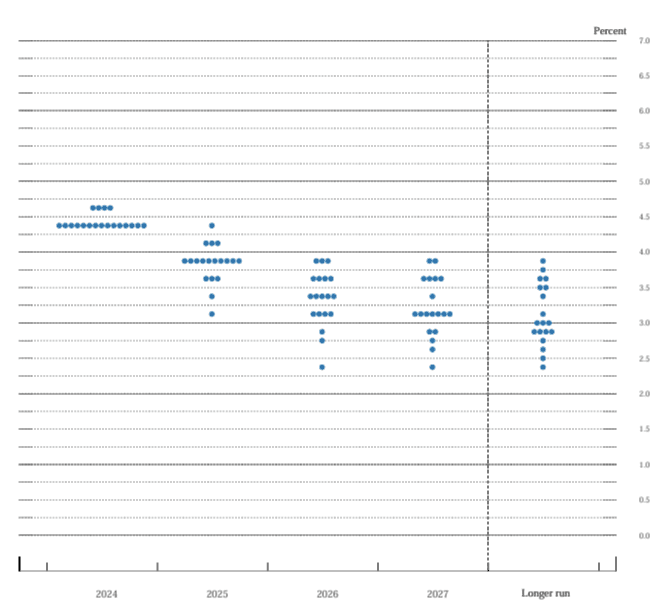

Interest Rates

The FOMC projects the federal funds target rate to decline to 3.9-4.0% by the end of 2025, down from 4.4-4.5% at the end of 2024. The committee expects to manage interest rates in a data-dependent manner to combat inflation and maintain a healthy economy.

In summary, the FOMC data for 2025 projects slowing GDP, slightly higher inflation, rising unemployment, and potential Fed Funds cuts in order to support the economy. However, several major banks/brokerage firms have placed targets on the S&P 500 reflecting high single-digit to low double-digit percentage growth. Given the gap in the current fundamental valuations and current levels, coupled with the above FOMC projections, it seems logical that both could occur, but a correction may be needed to provide more attractive entry points in the short term. Long-term investors should review their goals, timeline, & asset allocation, as well as having a thorough understanding of the risks that yo may be taking on.

If you would like to review your strategy and understand your portfolio risk, click the button below to arrange a time to speak.