A.I. related companies seem to be driving this market.

The first half of 2023 was one with strong market performance, as the S&P 500 returned 16.89%. However, deeper analysis paints a picture that isn't quite as rosy. The S&P 500 is a market-capitalization weighted index. When you look at the equal-weighted index, the return is only 5.97%. The difference is due to the significant influence of some of the largest companies, particularly those related to artificial intelligence. As of 6/30, seven mega-cap companies accounted for about 26% of the S&P 500 index, had an average return of 93% in 1H23, and a weighted return of 19.77% This also means that the remaining 493 stocks (with a 74% weighting) actually had a loss of about 3.90%. There are also some concerns about the sustainability of this market's rally.

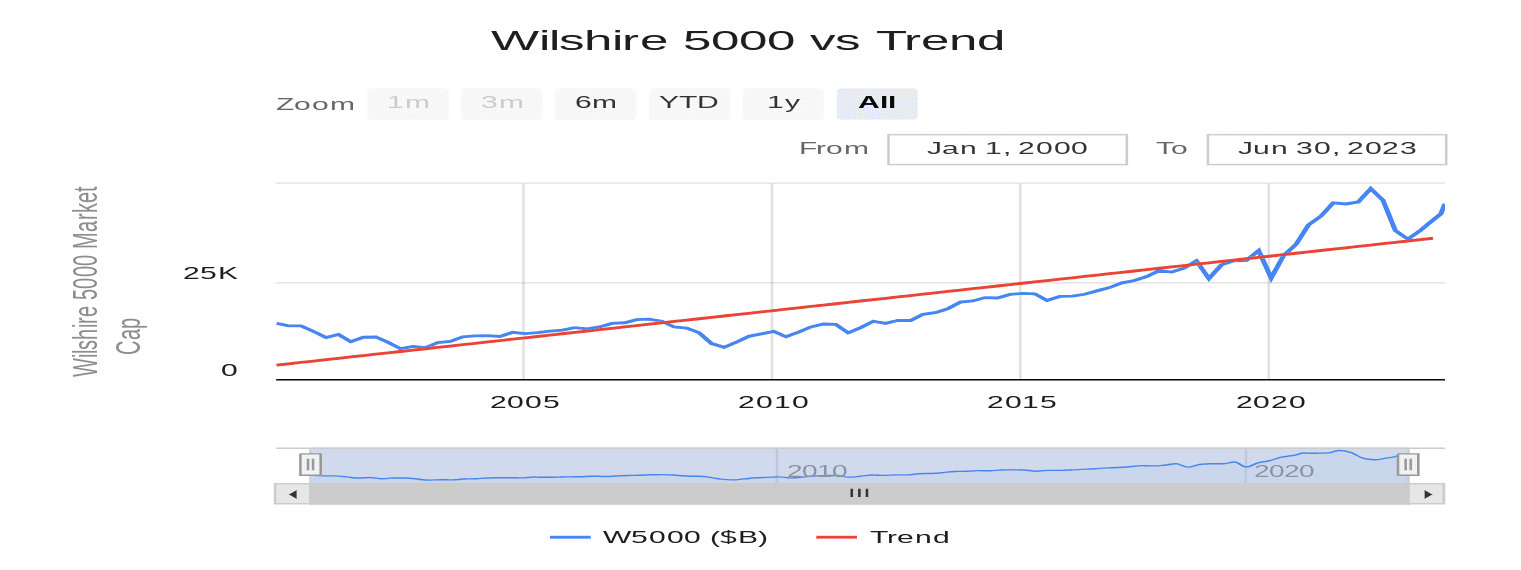

Valuations Seem High

As of 6/30, the Wilshire 5000 stock index (intended to represent the entire US stock market), is 1.6 standard deviations above its long term trend. This is a signal of being overvalued. Also, even with earnings recovering slightly, markets seem to ignore not only the Fed's current actions, but also the likelihood that they will likely have to continue raising rates because inflation has been so stubborn, and becoming embedded in consumer prices, which has been a stated concern ("...long-term price stability.")

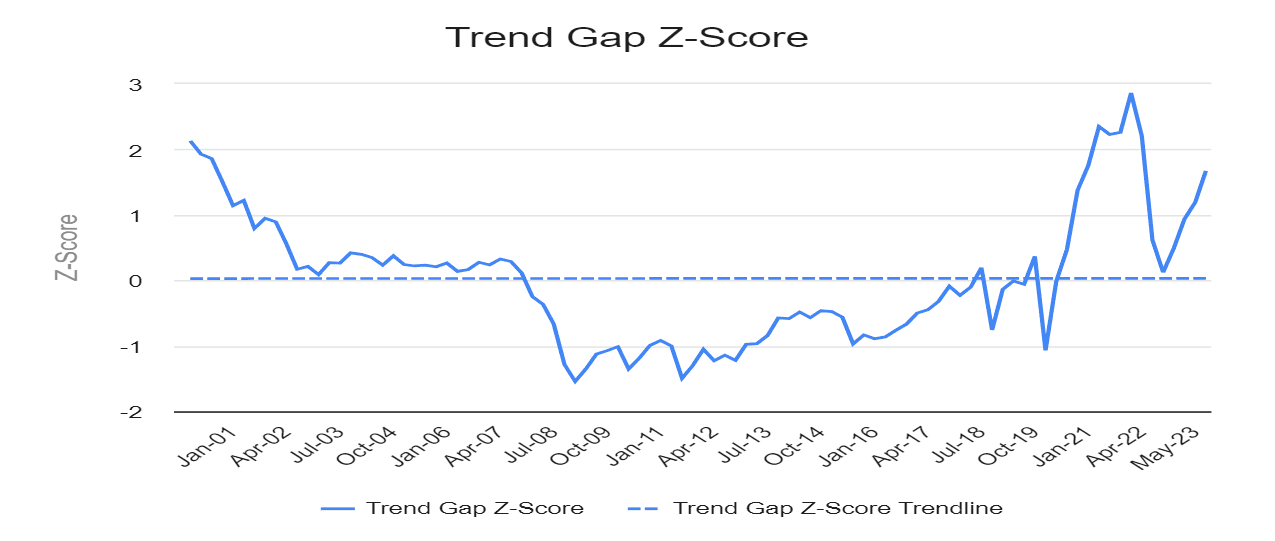

In other words, if the trendline in the previous chart (in red) was translated into a baseline (dotted line in this chart), the current market's deviation is similar to the "dot.com" bubble from 1999-2000, although not quite as large as it was before the Fed started raising interest rates in March 2022.

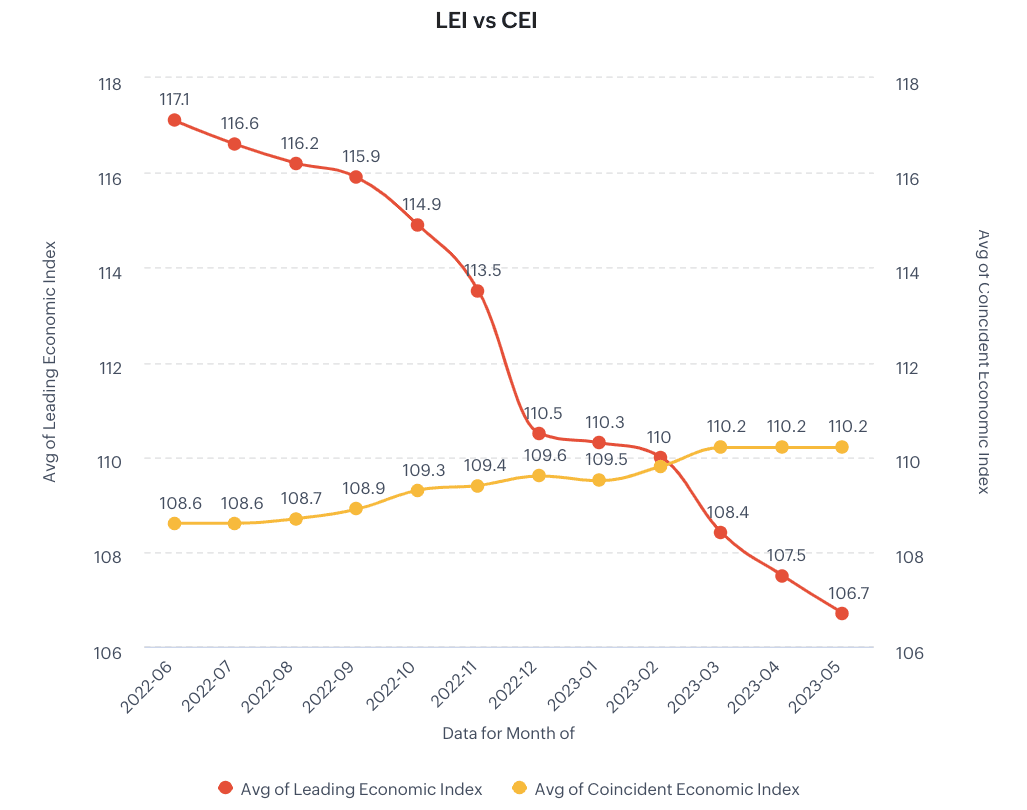

A Turn in the Business Cycle?

The Conference Board's Leading Economic Indicators have been less than its Coincident Economic Indicators for the last three months. In other words, based on the chart to the left, not only have survey results indicated more a more pessimistic outlook within 6-12 months from that particular survey date, but for the last three months they also have indicated that the near-future business cycle will be worse than the current situation. With the first gap being in March 2023, this indicates a potential turn in the business cycle starting in 4Q23 or 1Q24.

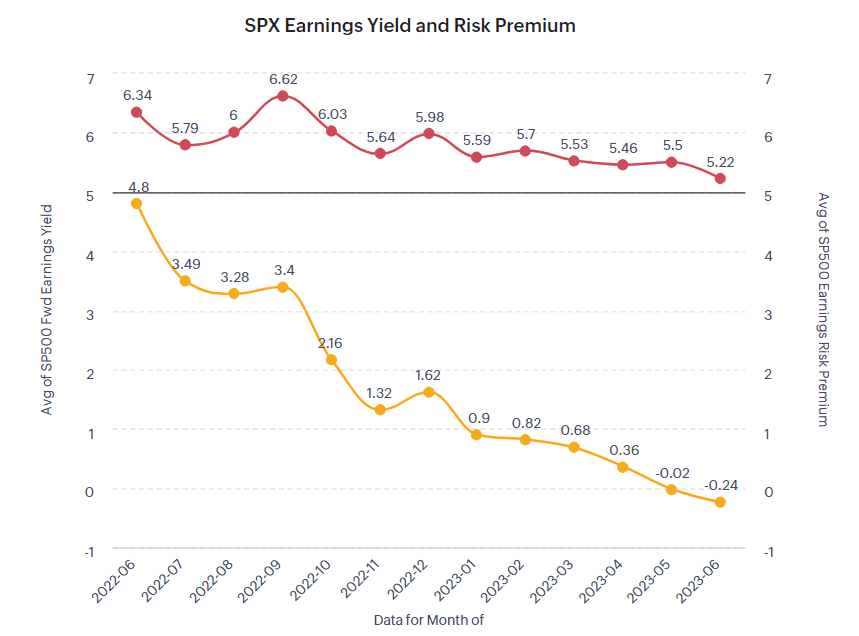

Paying a Premium for More Risk?

As of 6/30, the earnings yield on the S&P 500 was about 5.22%. The yield on the 3-month US Treasury bill was 5.46%. This means that investors are literally paying 0.24% to take on the risk of the stock market (instead of receiving a benefit of 4.5-5.0%). At some point, risk management and fundamental valuations will come back into focus, but as long as the market is increasing, many are content to simply ride the wave. This could lead to some good opportunities when the market corrects, especially if it overshoots the mark trying to correct.

In the short term, "caveat emptor" (let the buyer beware). To learn more about how our process could benefit your situation, click the button below.