Economic growth and stock returns have been weaker one year later

MAIN POINTS

An inverted yield curve is not a sufficient condition for a U.S. recession.

Tight financial conditions and/or weakness in the services sector would increase recession risk more meaningfully.

Inversion has been followed by increased volatility in stock prices and slower economic growth a year later.

Market volatility is back on the rise again. This time, investors are worried about an imminent recession. Their main concern - an inverted yield curve.

(What is an inverted yield curve? When short term yields like a 1 or 2 year bond yield is higher than a longer term bond yield, such as the 10-year bond.) There are many different maturities for government bonds, but a typical yield curve compares the 10-year treasury yield vs. a 2-year treasury yield.

Back in the spring other "yield curves" inverted which led to a 6.6% drop in the S&P 500. Recently, the above defined 10 year-2 year (10Y-2Y) yield curve inverted briefly, and the market again dropped 6%.

Yes, historically, yield curve inversion has been a good recession signal. Since 1976, five of six instances of a 10Y-2Y yield curve inversion preceded a U.S. recession by about 16 months. However, according to Ned Davis Research, a yield curve inversion alone is not a sufficient condition for a U.S. recession.

As the U.S. economy has become more service based, a key factor for recession risk occurs when financial conditions tighten (cost and availability of credit for households and businesses are going up) and/or the weakness in the manufacturing sector of the economy spreads to the services sector of the economy.

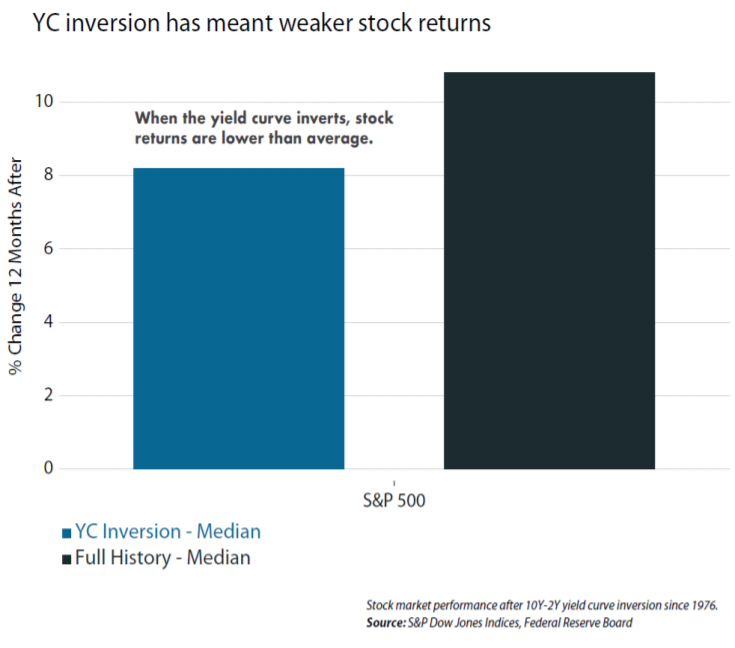

Historically, a yield curve inversion has been followed by lower stock market returns (chart below) and slower economic growth in the U.S. a year later. However, when the Federal Reserve is cutting rates (which they are currently considering), the stock market and economy have performed better.