"There is a fifth dimension, beyond that which is known to man. It's a dimension as vast as space and as timeless as infinity. It is the middle ground between light and shadow, between science and superstition, and it lies between the pit of man's fears and the summit of his knowledge. This is the dimension of imagination. It is an area which we call The Twilight Zone."

These words were written for the popular show of the early 1960s (and subsequently used in the mid 80s and soon in a 2019 reboot), but he could have also been talking about how many of us feel these days. Allow me to channel my inner Rod Serling for a few moments.

What if California were allowed to peacefully secede from the US? 14% of the United States' GDP would be gone, in another country. What currency would they use? Would any special restrictions be placed on those traveling to and from there? How would companies and individuals interact for buying products and services there? Could certain technology or movies be restricted for reasons other than national security, such as politics, or to protest unfair tax treatment by the rest of the US or other countries? Is secession really our best option?

These are the type of questions that the United Kingdom is dealing with in Brexit.

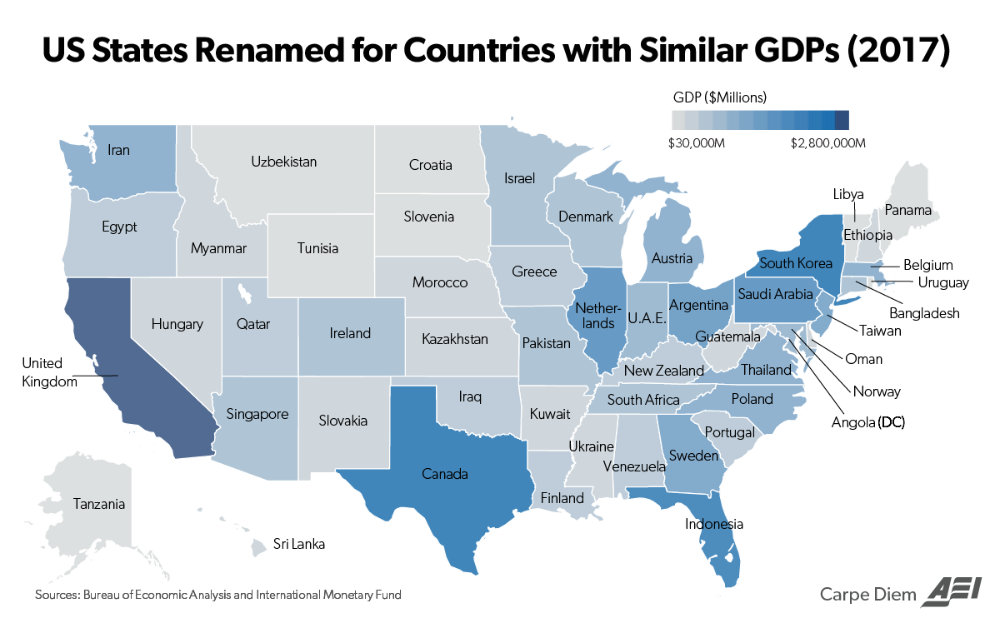

As you can see from the above graphic, California's economy is roughly the size of the United Kingdom's. Britain also makes up roughly 14% of the European Union's GDP. Brexit was born from several factors, including economic frustration & nationalism. The disagreement over how to exit couldn't come at a worse time, as the rest of the world also appears to have growth concerns, and London is considered the financial center of the EU.

So here we are, in between the "light" of the first three quarters of 2018, the "shadow" caused by Brexit and other factors (see my last post from November 30th), and the hope of a recovery. It is easy to base investment decisions from "the pit of your fears" rather than "the summit of your knowledge" at this point, because knowledge requires certainty and fear requires none. Instead, I suggest to reevaluate your perception, revisit your confidence in your plan, manage your current reality & build in flexibility for change for a new one. How else could you invest with such uncertainty, "between science and superstition", in the Twilight Zone?