Back-to-school sales suggest holiday sales growth is at risk.

MAIN POINTS

Retail stocks typically underperform in December.

Tariffs and projected weak holiday sales growth are additional risks for Retailing.

While internet sales continue to take share from department stores, even companies like Amazon aren't insulated.

December has not been kind to the Retailing Industry group.

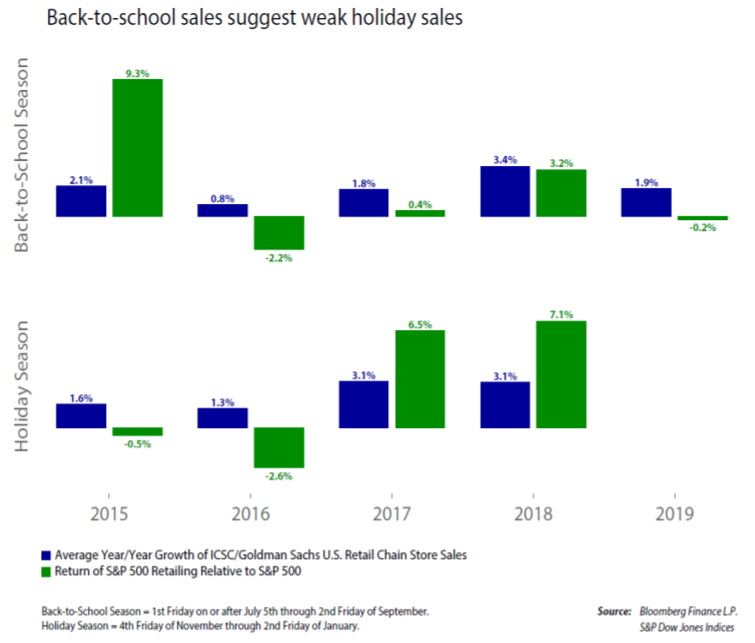

Historically, S&P Retailing has only outperformed in December 35% of the time, going back to 1954. This December may be particularly challenged given the risks. In 2019 back-to-school growth was only 1.9% (chart below), a large drop from last year's 3.4% rate.

Back-to-school sales growth is typically a good predictor of holiday sales growth, so we could see weaker growth versus 2018. According to Ned Davis Research, S&P 500 Retailing tends to underperform during the holiday season when the year-over-year growth rate slows (e.g. 2016), and outperform when the year-over-year growth is similar or higher (e.g. 2017, 2018).

Retailing is also at risk from tariffs related to the China trade agreement. While the planned October 15 tariff increase (from 25% to 30%) was held off, the December tariff increase of 15% is still on the table. This could impact common holiday gift items like cell phones, laptop computers, clothing, and toys.

Retailing has become more competitive. Internet sales continue to grow at the expense of department store sales. Even Amazon doesn't seem to be insulated. While Amazon's internet sales have continued to grow, its investment in one-day shipping and other ventures has caused a year-over-year profit decline for the first time since 2017.

In addition, there are signs that the sales growth rate for its cloud business, while still robust, may be slowing. The bottom line is that Amazon's stock may stall until consistent profit growth returns.