Maya Angelou Could Have Been Talking about Jerome Powell

Maya Angelou's famous quote is quite apropos with reference to the Federal Reserve. If you ever had a question on what Jerome Powell is trying to do right now, all you need to do is read his comments from Jackson Hole this past August.

"Restoring price stability will take some time and requires using our tools forcefully to bring supply and demand into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will likely be some softening of labor market conditions. While higher interest rates, slower growth, and softening labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

The Fed can't be any clearer. Demand must slow down to meet current supply levels. Economic growth will likely need to slow for some time in order to bring inflation down from above 8% down to its longer-term target of 2%. This means making borrowing more difficult & taking money out of circulation, Once demand slows, corporations will likely reduce costs by cutting production and reducing headcount. Consumers would likely reduce discretionary spending, and focus more on the necessities. The earnings performance and guidance for 3Q22 & 4Q22 could be an indication of how optimistic or cautions consumers may be, especially given the holiday season that is so important for retail companies.

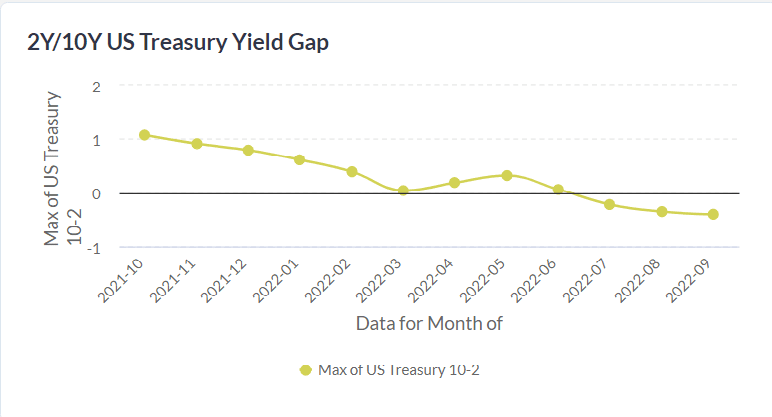

The spread between the 10-year Treasury and the 2-year Treasury has also been negative in recent months. This occurrence is often seen before a recession, which is usually not officially declared until several months after the fact.

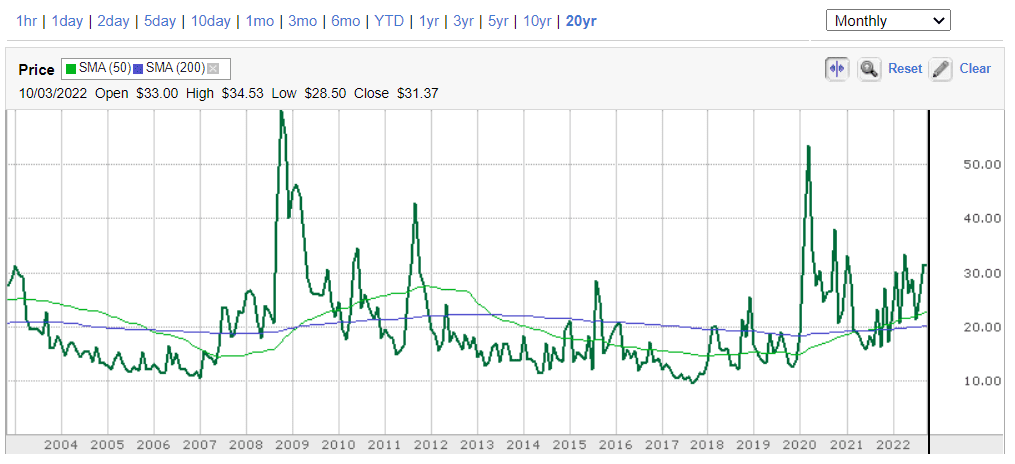

Volatility is also Increasing

Another possible harbinger of a market pullback is the Volatility Index ("VIX"), also known as the "Fear Gauge". Over the last 20 years, the VIX has been around 30 and associated with the following events:

- January 2020 = The early stages of the COVID-19 pandemic

- September 2011 = Double-dip recession fears; European debt crisis; US credit rating downgrade by S&P (from AAA to AA+; the US had a AAA rating since 1941).

- September 2008 = Global financial crisis