Data Signals Potential Slowing Growth

In a post dated 4/5/24 titled "The Stubborn Soft Landing", I wrote the following: "A soft landing is - unofficially - when monetary policy makers both slow the pace of economic growth and reduce inflation without causing a recession. So far, that appears to be the most likely scenario. I think even a mild recession, or a "soft-ish" landing, could be understandable at this point. One factor I have been monitoring has been the unemployment rate, which is beginning to rise slightly despite being near historic lows." Since then, unemployment has risen from 3.8% to hover between 4.0-4.3% range for several months. Monetary policy had appeared to do its job for a soft landing. However, more recent fiscal policy has caused a distinct change of direction.

Many of you may have heard me previously describe the US economy like a submarine; it's massive, has tremendous momentum, and can change directions, but doesn't turn on a dime. Likewise, we have received signals, like a sonar ping, that help tell a story. These tariffs, however, seem to have caused the economy & markets to be more like a "Crazy Ivan" (a hard turn made by a submarine to check its blind spot and potentially gain a tactical advantage, made famous by The Hunt for Red October by Tom Clancy).

The Federal Reserve's outlook for 2025 according to the December 2024 Summary of Economic Projections called for slightly higher inflation, rising unemployment, slower GDP, and 1-2 possible rate cuts in order to support the economy. The Federal Reserve Bank of Atlanta also created an estimate of GDP for 1Q25 through an analysis of current data. The GDPNow estimate showed a contraction from 2.9% on January 31 to (1.5%) this week, due to reports reflecting softer consumer spending, lower consumer sentiment, & fewer capital expenditures than expected. There is also a concern about companies front-loading their imported goods before the tariffs take effect in April in order to take advantage of lower prices.

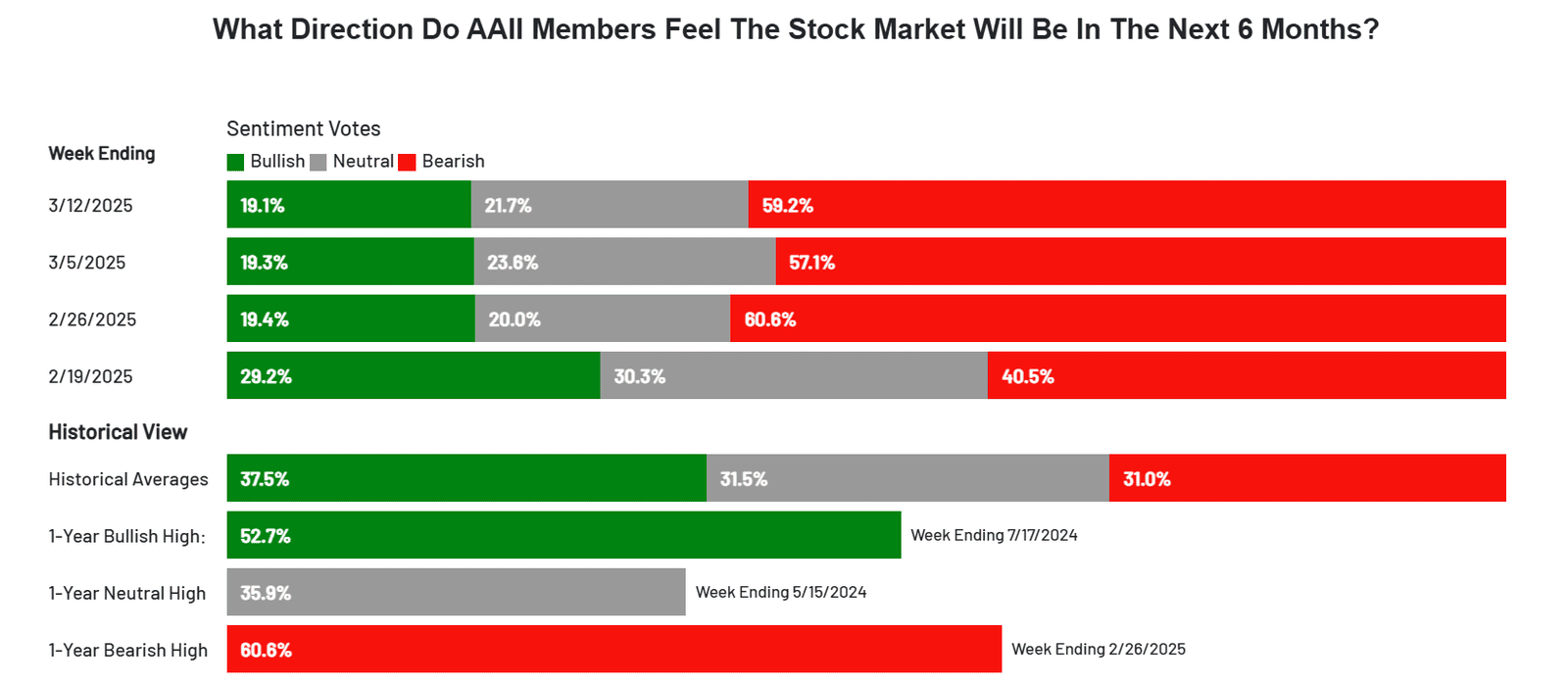

Your portfolio's total return has two components: appreciation/depreciation & income. Less confidence in the stock market usually leads to an increased focus on generating portfolio income (dividends & interest). However, lower investor sentiment also could lead to contraction in the Price-to-Earnings ratio. The P/E ratio basically shows how much an investor is willing to pay for an investment for every dollar in earnings that investment generates. Given the above points, it would be logical to think that earnings would be negatively impacted, so investors wouldn't be willing to value the investment the same as they did before. The greater the uncertainty, the more an investor would want to be compensated - which usually means a lower purchase price (i.e., market depreciation).

So, if you have more uncertainty regarding the stock market than you did a month ago, you might want to be compensated for taking on additional risk by investing more at lower prices, depending on your personal goals, circumstances & risk tolerance.

There is a lot of uncertainty presented in today's markets. With the right plan in place, we can work together to help guide you through these times with a sound strategy that is tailored for you. If you want help navigating all of the noise, click the button below to schedule a time to speak.