2023 was all about the "Magnificent Seven" stocks. What does 2024 hold?

Markets in 4Q23 ended with basically an entire year's worth of returns in a decent year. Large cap stocks were up over 26%, small caps were up almost 17%, and international developed markets were up nearly 19%. Both fixed income and cash equivalents (as measured by the 90 day US T-Bill) were up more than 5%. But let's delve into the details a little further. Will we have more of the same in 2024?

"Magnificent 7" Stocks Skew Market Returns

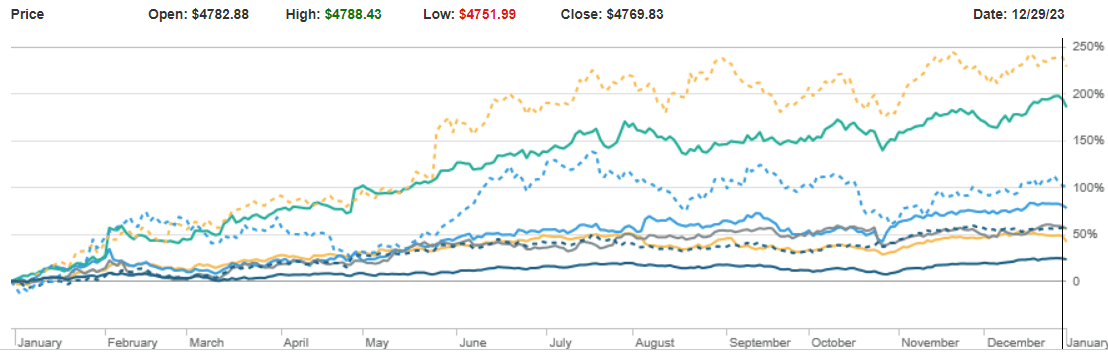

Last year was all about the "Magnificent 7 stocks" (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA) which are perceived to be best positioned to benefit the most from the A.I. trend. The markets have become distorted due to the outsized, over-weighted performance of these companies. This chart is the S&P 500 along with the Magnificent 7 stocks. Note how the 26.29% return of the S&P 500 (the bottom line) is dwarfed by the other returns. For comparison, if we equally weighted all companies in the benchmark, the return would have been just under 12%. These seven companies have represented 25-30% of the total stock market value, and had an average return of 108% in 2023. This means that the remaining 493 stocks, representing 70-75% of the index value, provided basically NO return in 2023.

Interest Rates are actually Returning to "Normal"

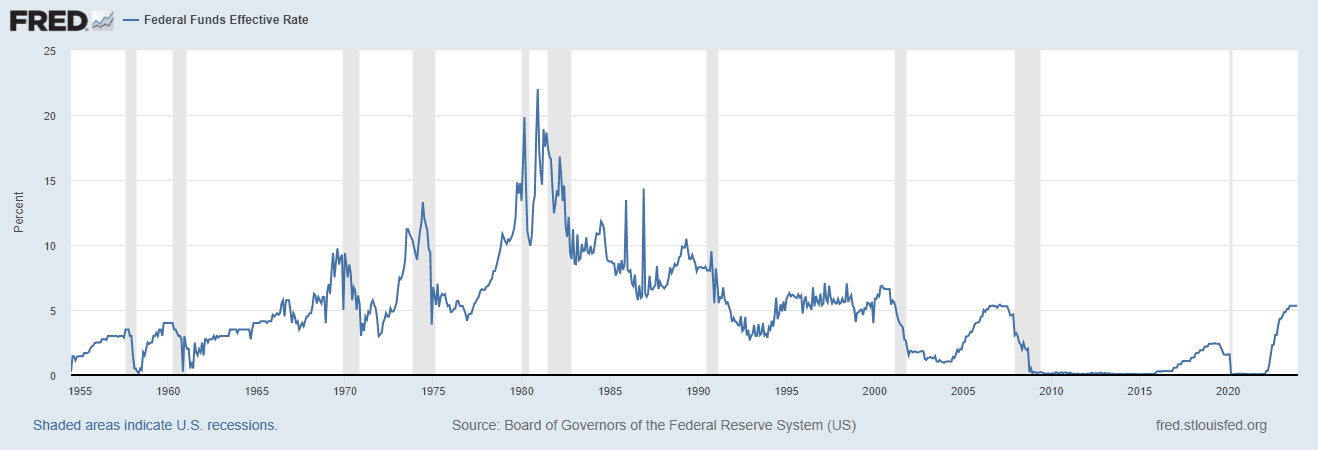

It is also important to remember where interest rates have been historically for context. This chart shows the Fed Funds Effective Rate going back to 1955. While there was a spike in the 1980s due to an energy crisis, it could be construed that we are presently in a normal range. Most of the last 20 years, we have had an exceptionally accommodative rate environment because of three "once in a lifetime" type of events: the tech bubble; the Great Financial Crisis; and COVID-19. The current environment is normal historically, but there is an entire generation of investors for which this is a shock.

Investors should also remember that any interest rate cuts would be due to a slowdown in economic activity (prompted by the lagging impact of interest rate increases), not just where headline inflation lands. We still have a long way to go. The chart also shows how many cutting cycles have been in or followed by a recession, which is one of the reasons why 1H24 could have a slowdown, whether defined as a "soft landing" or later officially defined as a recession.Conclusion

Fear of missing out on the AI craze drove the equity markets in 2023, although several measures indicate that valuations may be too high at this point. Similarly, consumers continue to drive this economy, although household balance sheets have slightly deteriorated due to higher debt spending. Many experts believe that the first half of 2024 will be affected by both of these trends before resuming a more normal course of behavior.

Prudence will be necessary, and, as I have stated previously, having patience is hardest when it is needed the most. 2024 may have some noise to it, and bumps along the way, but I believe we will be even better as we navigate our way through.

If you have questions about how to navigate these risks, click the button below to discuss your situation more in depth.