The FOMC Outlook Details Reflect Some of our Concerns

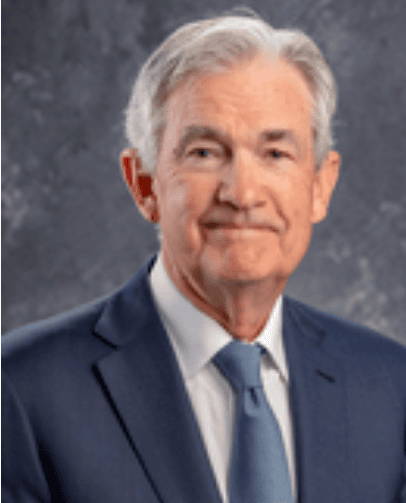

Earlier this week, the Federal Reserve cut the target Fed Funds rate by 0.25%, to a range of 4.00-4.25%. The clear concerns from the September 17th preliminary comments & press release were more focused on the labor market rather than inflation. Chairman Powell stated "The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen." This makes perfect sense, especially given much of the recent brouhaha over downside jobs revisions.

The Fed is walking a very fine line. Remember that inflation hasn't been been under 2% since February 2021. With the awkward rollout of the tariffs, their full impact is just starting to be felt. At some point, the consumer's ability and willingness may break under the weight of a weakening labor market. While cutting interest rates may support demand in the short term, if it weakens, companies may accelerate efforts to increase efficiency, especially through the growth of AI and the subsequent capital expenditures of supporting data centers.

My quarterly commentary from 4Q24 stated "...the FOMC data for 2025 projects slowing GDP, higher inflation, rising unemployment, and potential Fed Funds cuts to support the economy. However, several major banks/brokerage firms have placed targets on the S&P 500 reflecting high single-digit to low double-digit percentage growth. Given the gap in fundamental valuations and current levels, coupled with the above FOMC projections, it seems logical that both could occur, but a correction may be needed in the interim to provide more attractive entry points in the short term. " I still feel the same way. Valuations are exceptionally high, but there had been no catalyst to make them head lower. The impact of the trade war may be the catalyst for a reversion to the long-term trend, and if so, could create an even more attractive opportunity.

Aa a disciplined investor, I want to have a sense that what I'm paying for something is a fair price for the risk I'm taking. If an investment has more risk, I want to be compensated through a lower purchase price, which gives me a better chance at a return that makes that risk worth taking. Instead, this market has been what I would consider an "irrational" risk-on market. In other words, people acknowledge that prices are probably too high in the short-term, but choose to chase returns anyway and ignore economic concerns and the long-term valuation comparisons. This is a practical example of something I've said before and will say again: CONTROL WHAT YOU CAN AND PLAN FOR WHAT YOU CAN'T.

If you want to discuss more practical ways to implement risk management in your portfolio, whether you're seeking current income or aggressive, long-term growth, click the button below to schedule a consultation.