Earnings May Start to Get More Attention

Our focus has been on the Federal Reserve's tightening cycle for some time, and on COVID stimulus prior to that. A fundamental aspect of investing has gotten lost in the meantime, but it may start to get more attention in the near future - EARNINGS. At a base level, when we invest in stocks we become equity owners of that company. Owners want their companies to make money, both as top line revenue, and more importantly, as bottom-line earnings. It seems that we have lost sight of how important earnings are, especially regarding fundamental valuations.

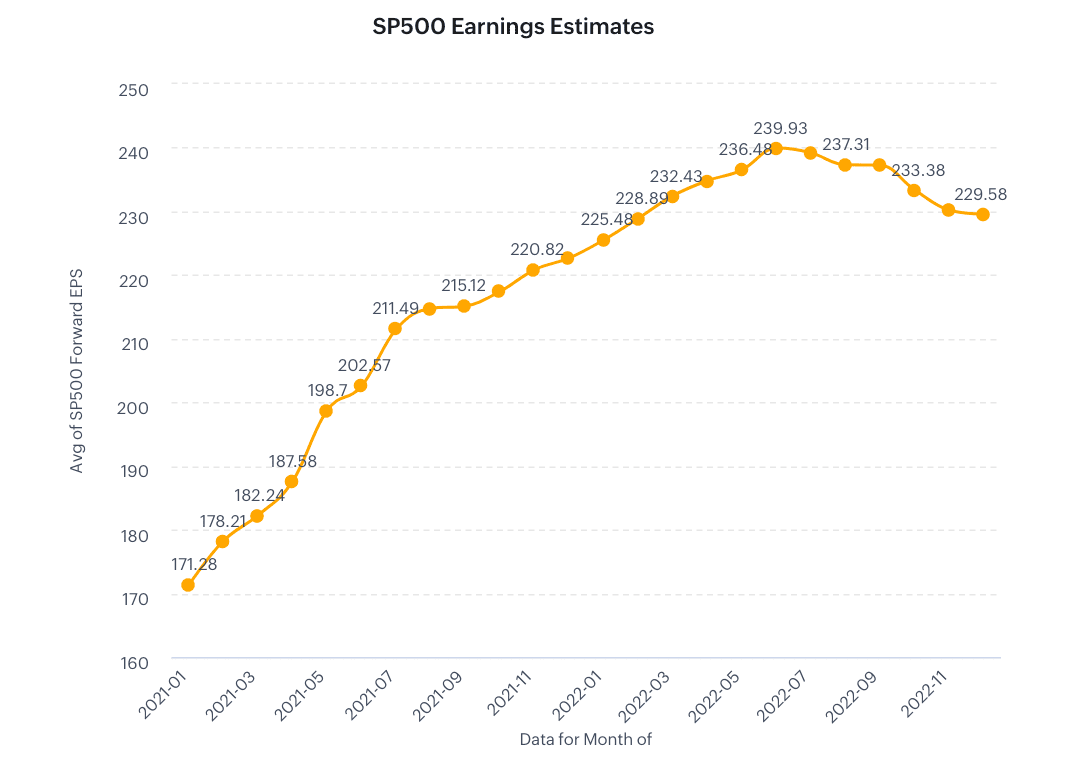

S&P 500 Forward Earnings Estimates Have Begun to Turn Over

Fed rate increases take time to work through the economy to have an impact. The first post-COVID increase occurred in March 2022 at 0.25%. However, S&P 500 forward earnings per share (EPS) estimates did not peak until June, and began to decline in July. I believe that the decline in estimates still has a way to go. If that turns out to be the case, and if P/E ratios approach historical norms, it could be a bumpy ride for a while.

This would be a classic example of one of Bob Farrell's Rules of Investing, as I've quoted in previous posts: "Bear markets have three stages - sharp decline, reflexive rebound, and a drawn out fundamental downtrend.

With an increased focus on fundamentals, higher rates, and considering the Fed is still taking money out of circulation, a continued market pullback is certainly possible in 2023. However, the Fed also understands the tightrope they are walking: slowing down the economy just enough to tame inflation compared to pushing it into recession. Asset depreciation may be a casualty of their efforts, but only time will tell.