Recovery or Bear Market Rally?

4Q22 provided a substantial bounce in the markets as inflation continued to decline from its June peak. However, the market's performance in 4Q22 was probably premature in terms of being a sustainable recovery. It appears to be a typical bear market rally.

| STYLE | 4Q22 | 2022 |

| Russell 1000 Index | 7.24% | (19.13%) |

| Russell Midcap Index | 9.18% | (17.32%) |

| Russell 2000 Index | 6.23% | (20.44%) |

| MSCI EAFE Index | 17.40% | (14.01%) |

| MSCI Emerging Markets Index | 9.20% | (22.37%) |

| Bloomberg Aggregate Bond Composite Index | 1.87% | (13.01%) |

| US 90-day Treasury Bill | 1.00% | 2.01% |

The Economy Still Has a Way to Go

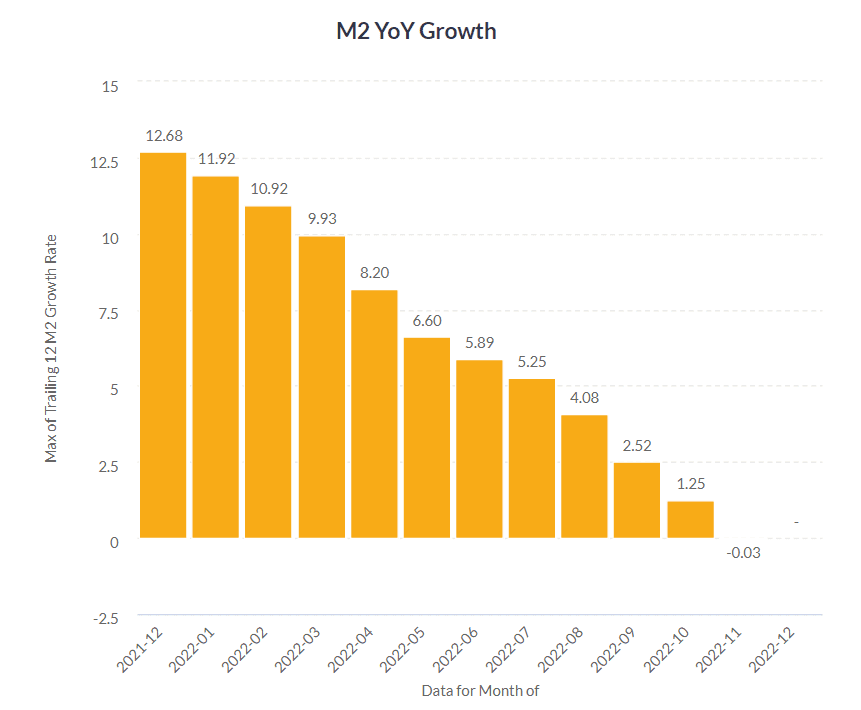

Investor optimism seemed to increase in 4Q22 since inflation declined to 7.1% from its June peak of 9.1%. However, even with the improvement in CPI, we must remember that it takes time for rate increases to have a tangible impact on the economy. If we assume a 6-12 month lag for rate increases to have an effect, we are just beginning to see the impact on slowing down demand. Remember how aggressively the Federal Reserve Board of Governors has acted in their attempts to tame inflation. Not only were Fed Funds rates raised by more than 3.50% in the latter half of 2022 in order to slow demand, but the Fed is also slowing the growth of money in circulation, as you can see in this chart. I would not be surprised to see funds being pulled out of circulation to slow demand further to bring inflation to the stated 2% long term rate, especially given the amount of funds that have been put into the economy over the last several years as support for various reasons.

The challenge is how much to press on these economic brakes while making sure the "car" is still moving forward.

There were three times in 2022 when the markets declined more than 10%. Each time, the subsequent recovery failed to meet it's previous high, and the following lows went even lower. I believe we might be in the fourth leg of this cycle since rates will still likely increase in the first three to six months of 2023.

Another concern is valuations. the year-end P/E ratio for the S&P 500 was roughly 16.7, which is only slightly elevated in "normal" times, but quite elevated given the current level of inflation. However, with a backdrop of higher inflation (i.e., increased risk) than historical norms, buyers should be compensated with lower prices. Given the outlook for interest rates, one could easily make the case that the P/E ratio should be even lower.

Pundits seem to be searching for the identity of this economic environment for 2023. Throughout much of last year, we began to hear the same refrain that is being echoed now. "The Fed is going to have to pivot (to cutting rates) in order to keep the economy from going into recession. To put it nicely, I think it is (and has been) hogwash to take this position when the Fed has told you explicitly what they are going to do and have not deviated from that path. Consider the following quote from Fed Chairman Jerome Powell's speech at the Jackson Hole retreat in August 2022.

"Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."