In 2020, the economy has vacillated between having one of the worst bear markets in history to an unprecedented market recovery. Now, it seems that investors, analysts, and pundits alike are trying to determine if the economy will catch up to the market and reach new highs or if the market will pull back to where the economy is. Generally, I would suggest that the economy would meet the market because the stock and bond markets are meant to be forward-looking instruments. However, with valuations so far from normal, and since we still don't have a coronavirus vaccine yet, the only certain thing is that everything is uncertain.

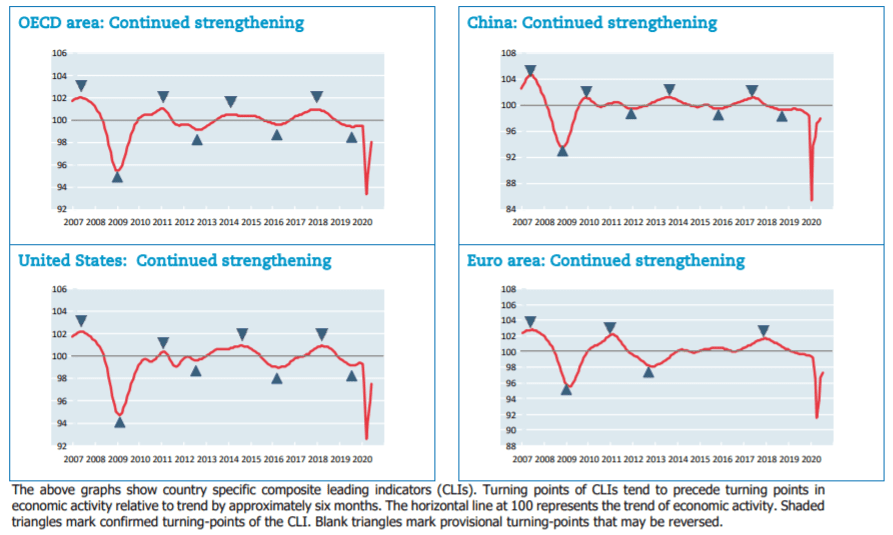

The good sign is that the Organisation for Economic Cooperation and Development (OECD), an international economic policy setting organization, sees the slowdown easing in all major economies. In China, there are even signs of growth regaining momentum.

While this is certainly welcome news in the U.S., we must certainly acknowledge the risk of renewed shutdowns due to a potential second wave of COVID-19, which may also coincide with the seasonal flu virus. Another consideration is that "less bad" isn't the same as "good". We still have high unemployment, including recent months that potentially underrepresented the number of people laid off, so we still have a long way to go. When it does come down, then we'll also need to gauge how quickly consumer demand for various goods and services return compared to paying down debt, preventing eviction, or simply just saving it and rebuilding their personal balance sheet.

Finally, I am also looking at the valuation gap that exists between current levels and historical norms. I think this plays out in one of three ways.

- Operating earnings estimates increase sharply to meet asset levels.

- Operating earnings estimates will rise gradually to meet reasonable levels, but it will take more time (meaning sub-par growth; a "U" or "W" shaped recovery).

- Asset levels will pull back to meet the current level of operating earnings.

Which do you think will occur? I'd love to hear your thoughts. (I'll save my opinion for a later post.)