Jackson Hole could provide some insight.

Last year during his speech at Jackson Hole, WY, Federal Reserve Chairman Jerome Powell stated the following:

"Restoring price stability will take some time and requires using our tools forcefully to bring supply and demand into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will likely also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

What is unclear is not if the Fed feels accomplished; it's likely they do not. Rather, the question may be how much further do they need to go? Despite inflation's decline over the last year, it has done so without slower growth or significantly softer labor conditions.

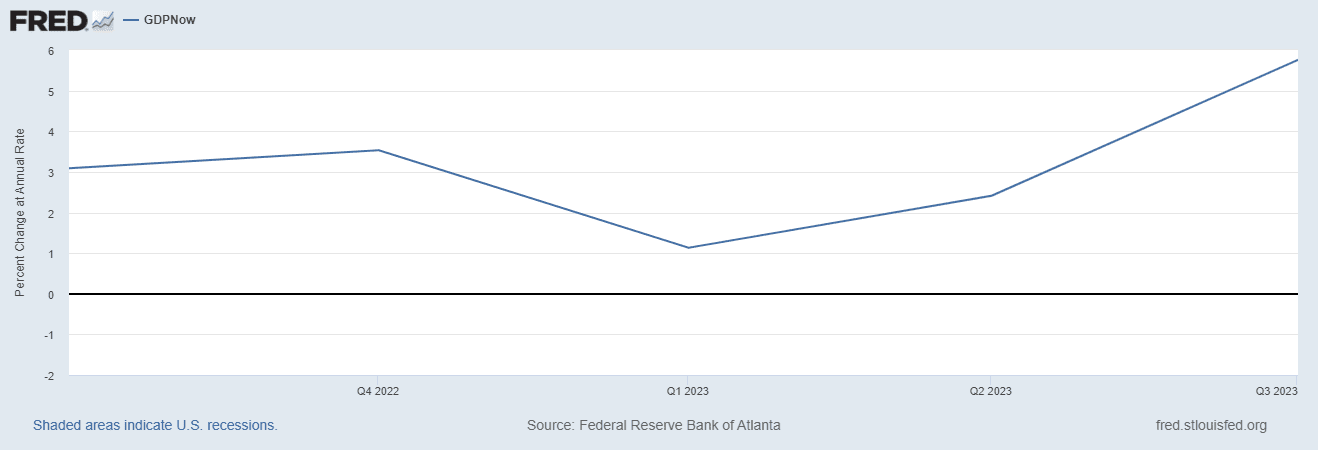

Growth Continues to be Strong

This chart reflects GDPNow, an estimate of the Gross Domestic Product for the United States, managed by the Federal Reserve Bank of Atlanta. The GDP estimate had slowed to be just above an annualized rate of 1.13% in 1Q23, but the estimate for 3Q23 is now roughly 5.75%, even with the reduction of the money supply (M2) and all of the interest rate increases that have occurred.

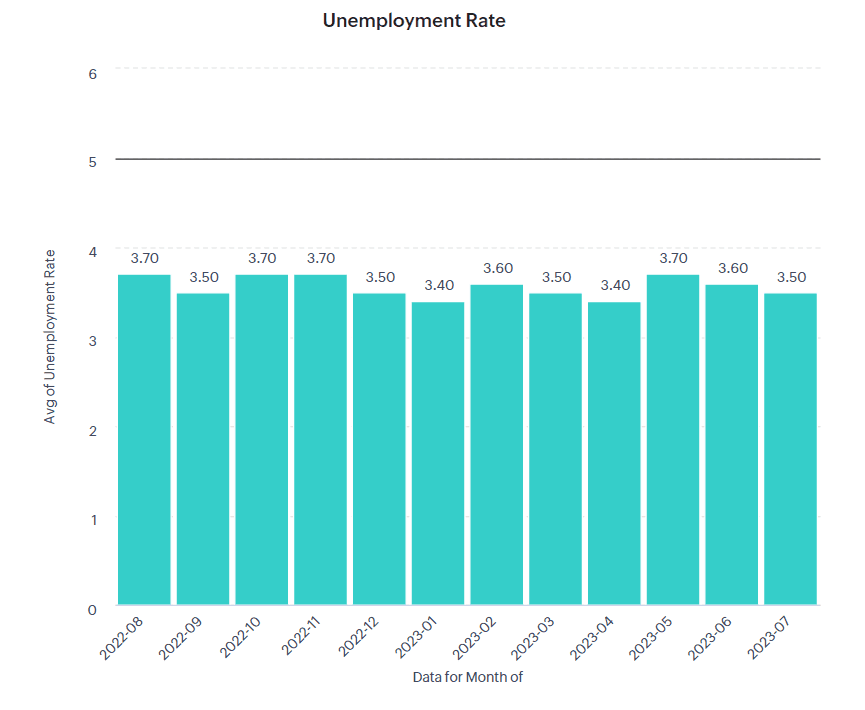

The Labor Market is Still Tight

The unemployment rate has been pretty stable over the past year, according to the Bureau of Labor Statistics. In fact, despite the four-week average of initial jobless claims moving slightly higher this year, the unemployment rate sits lower than a year ago, at 3.50%, much lower than the theoretical rate of "full employment". Continued claims for unemployment insurance are also lower than before the COVID-19 pandemic began (1,879,000 for the week ending 1/4/2020; 1,716,000 for the week ending 8/5/2023).

Why is this important? A tighter labor market leads to higher wages, which likely also leads to more consumer spending. It seems as if the full impact of the interest rate increases over the last 18 months still has to be felt. We may be toward the end of the Federal Reserve's rate-hiking cycle, but I would not be surprised if the Fed keeps rates higher for longer than what some believe.

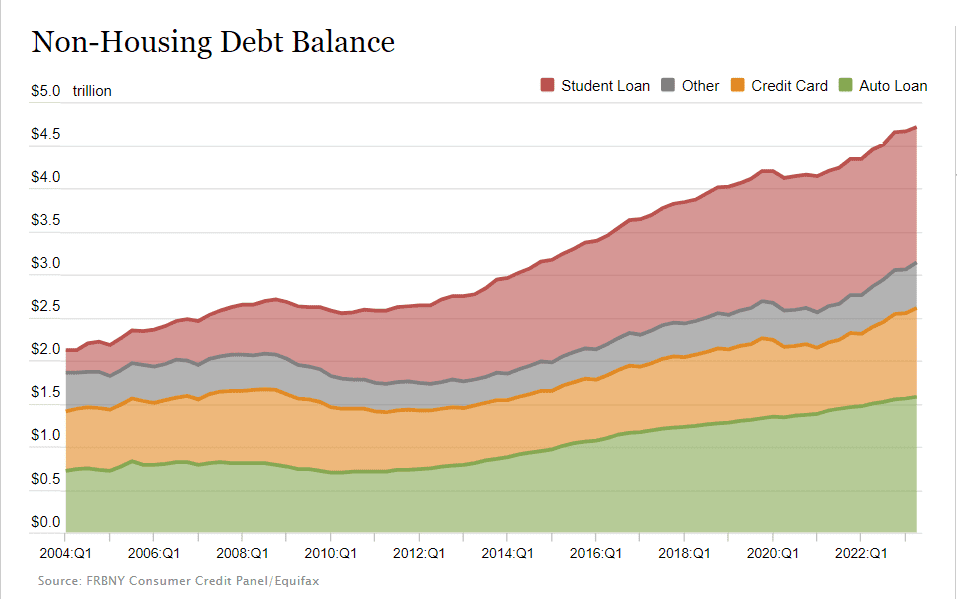

Watch Household Credit & Consumer Spending

Consumer spending & household debt could be one measure signaling if the US could have a soft landing or a recession. The housing market has already slowed over the past 12-18 months, as interest rates have risen and sellers (with mortgages at historically lower rates) are hesitant to upgrade with mortgage rates around multi-decade highs. Affordability is also much lower due to limited housing supply. In addition, according to the most recent quarterly Household & Credit Report by the New York Federal Reserve Bank, two concerning points were raised.

- "Credit card balances saw brisk growth, rising by $45 billion to a new series high of $1.03 trillion."

- "Credit card balances saw the most pronounced worsening in performance in 2023Q2 after a period of extraordinarily low delinquency rates during the pandemic."

Conclusion

Continue to watch reports on household credit & consumer spending closely as we enter 4Q23, especially during the holiday spending season. In my opinion, if consumers initiate a slowdown in spending (because they feel less confident in the economy), we may have a more moderate slowdown, i.e., a soft landing. Households would likely pay down debt &/or improve their respective balance sheets. However, if lenders proactively created a somewhat tougher lending environment in order to manage risk & mitigate the increase in delinquency rates, it might induce increased market volatility and lead to a recession. While painful in the short term, it could also create better long-term opportunities because of the more reasonable valuations.

If you have questions about your current strategy and how you are managing risk, click the button below to schedule a call.