The Battle Against Inflation is Not Over

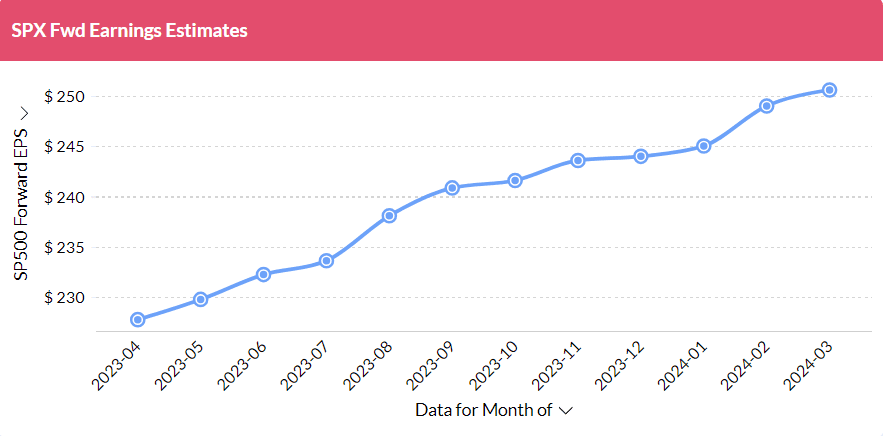

The S&P 500 is up just roughly 25% since late October, and the other benchmarks have also continued their momentum. The improvement in forward earnings estimates would appear to justify the growth. Other styles have also performed well. The underlying sentiment seems to be that a soft landing was likely, and the Fed would cut rates numerous times this year to keep the economy from slowing too much.

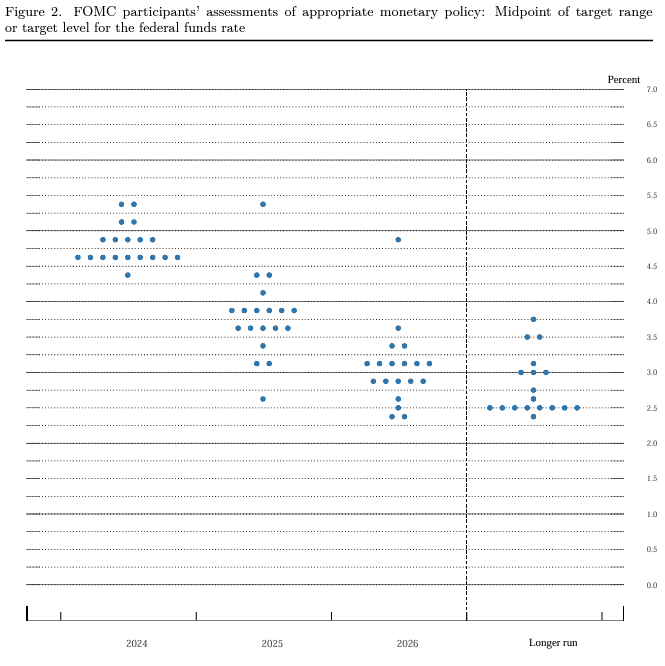

This excerpt from a recent Federal Open Market Committee (FOMC) report, known as the "Dot Plot", reflects how views on the economy have changed. While some market analysts have anticipated as many as seven rate cuts in 2024, this shows that the FOMC members anticipate that there will likely only be three cuts in 2024, leading to a Fed Funds rate ranging from 4.50% to 4.75%, from the current range of 5.25%-5.50%.

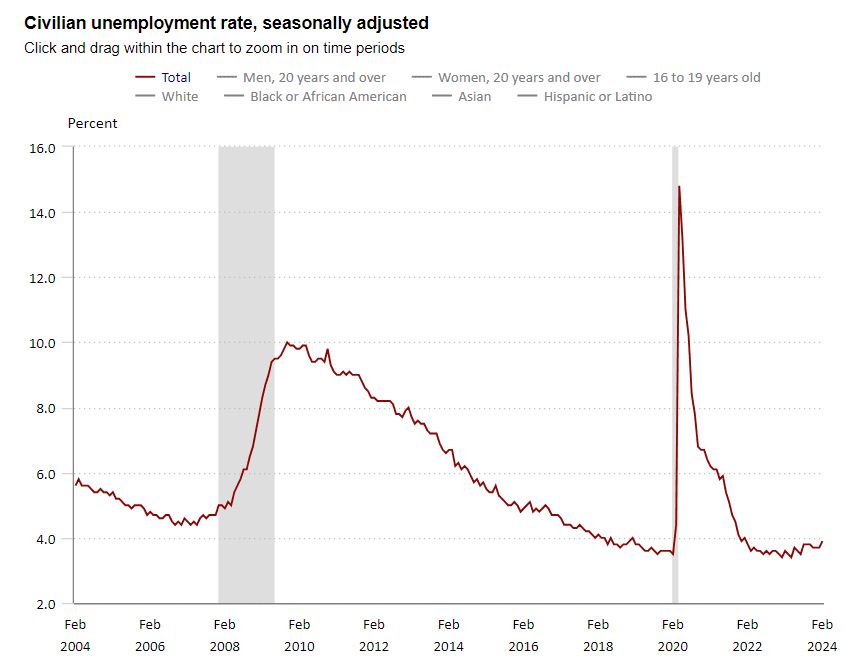

This would also explain the recent bond market performance, since a lack of anticipated rate cuts would lead to investors searching elsewhere for more attractive return prospects.A "soft landing" is - unofficially - when monetary policymakers both slow the pace of economic growth and reduce inflation without causing a recession. So far, that appears to be the most likely scenario. I think even a mild recession, or a "soft-ish" landing, could be understandable at this point. One factor I have been monitoring has been the unemployment rate, which is beginning to rise slightly despite being at near historic lows.

Unemployment was measured at 3.9% as of February 2024, the most recent reading as of publication. If actions by policymakers cause consumer demand to slow too much, companies may begin to slow production &/or reduce headcount as an attempt to maintain progress toward their financial goals. This could lead to an increase in unemployment, causing consumers to spend less, and continuing the cycle.

2023 was all about AI-related stock "FOMO" (fear of missing out), resulting in a few stocks with outsized gains & dragging the market along with it. I believe 2024 will be all about the FOMC's focus on managing inflation. If inflation remains stubbornly above the long-term goal of 2%, interest rates will be "higher for longer" and will dominate the conversation all year (up to & possibly during the election).