We've Made Progress, but We're Not Out of the Woods Yet

COVID-19 variants slowing growth

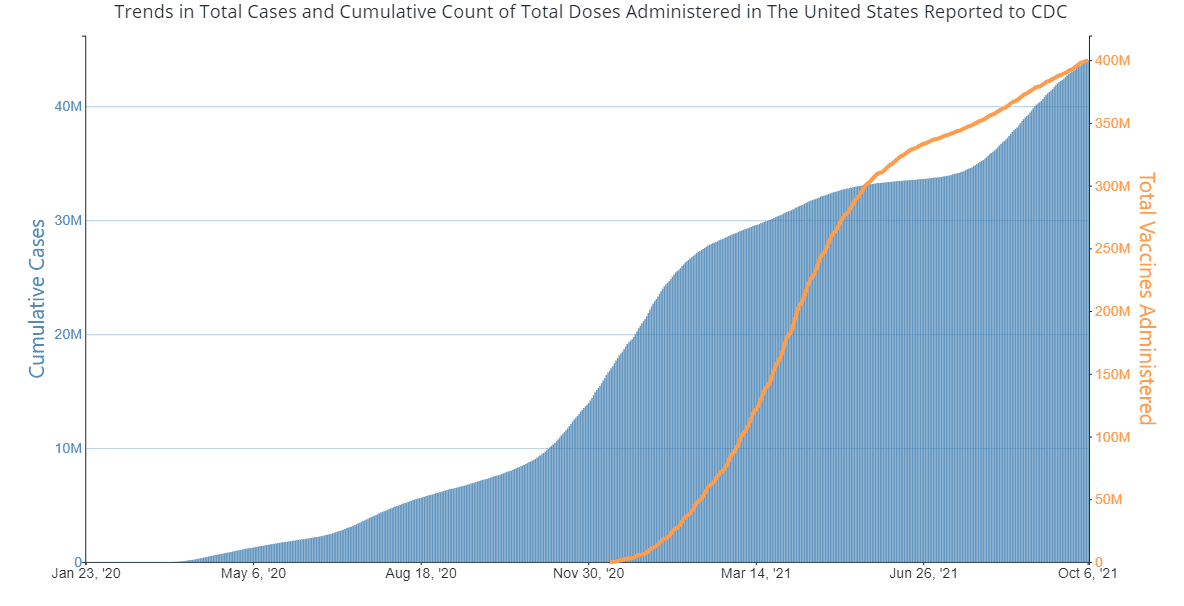

The mass distribution of an effective vaccine in 4Q20 (see chart) began the return to normal. While the rate of total cases slowed as vaccines were initially being taken, the variants that occurred in 3Q21 have caused an increase in the number of cases. This uncertainty could prevent the economy from continuing its recovery at the same pace, though it is only one of a few potential risks

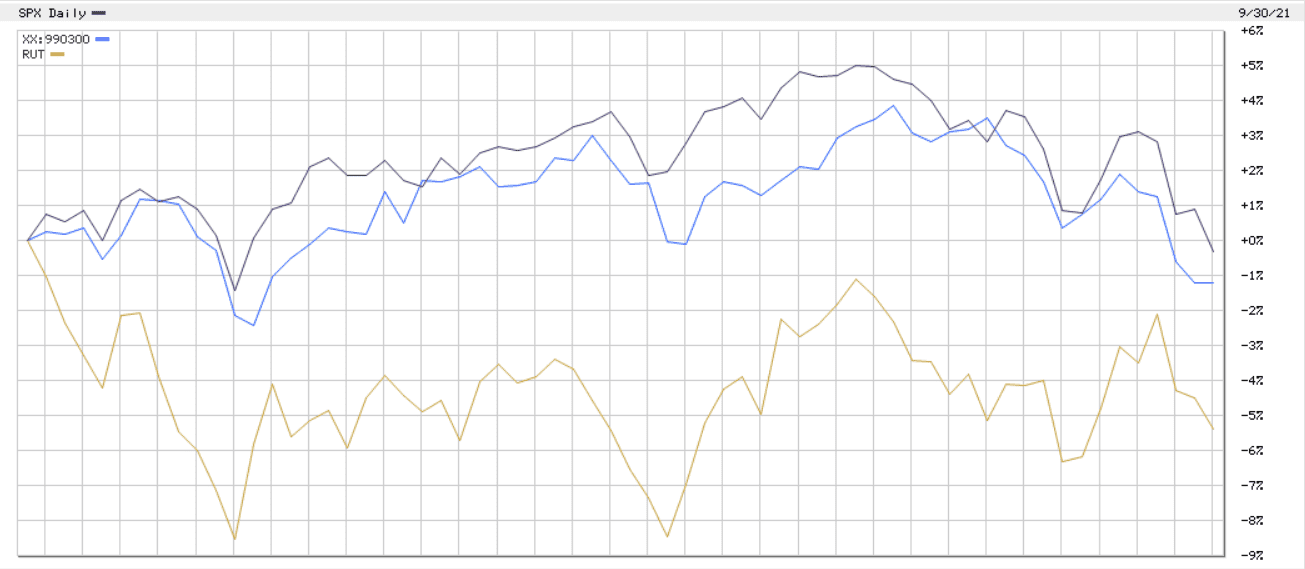

2021 has been a great lesson in perspective for investors. As a whole , it has been mostly a positive year. The economic recovery, fueled by favorable fiscal & monetary policies had been strong in the first half of the year. However, when we examine 3Q21 performance alone, we get a slightly more concerning picture. The

S&P 500 (large cap/black line) and and the MSCI EAFE (international/blue line) were flat, decreasing about 5% in September alone, and the Russell 2000 (small cap/beige line) declined about 5% for the quarter.Valuation Still Matters

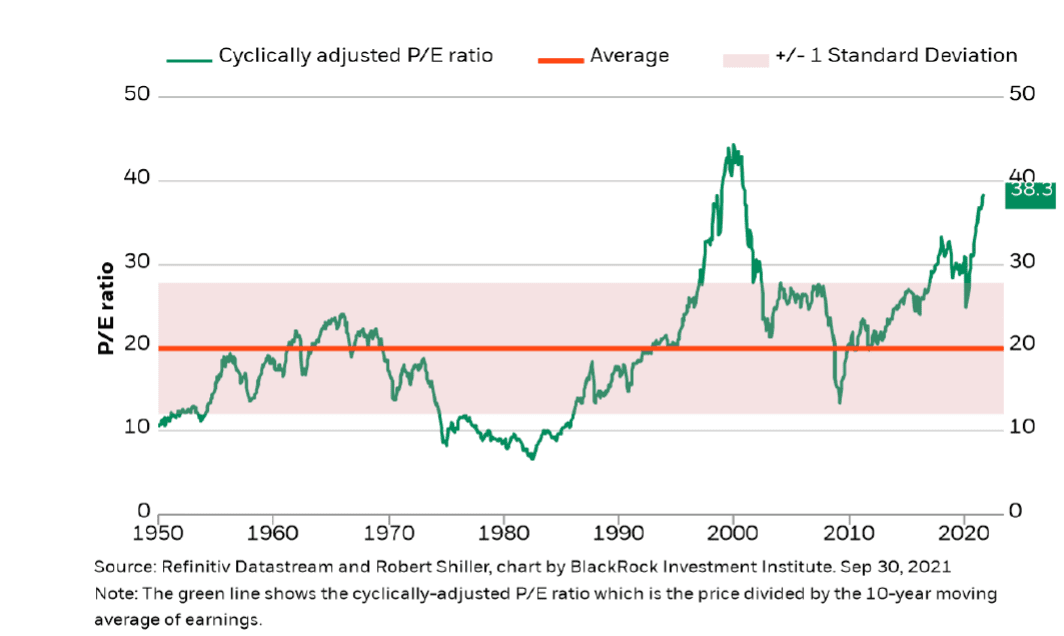

By some measures, the S&P could be considered overvalued in both the short- and long-term. The long-term implication of being overvalued is that we may have an extended period of sub-par returns in order to revert to the historical average. The Cyclically adjusted P/E Ratio (also called the Shiller CAPE Ratio or P/E 10) takes inflation into consideration over a 10-year period and adjusts earnings accordingly. The PE 10 for the S&P 500 ended the quarter around 38.3, the highest reading since the tech bubble of the early 2000s.

Inflation & the Supply Chain

Both the Consumer Confidence Index and the Chicago Business Barometer retreated in September. While the US economy continues to display resilience, the pullback may last until the pandemic-related supply chain issues can be rectified. Click here for a six-minute video on the issue. The bottom line: the demand of the coronavirus recovery overwhelmed the system, & goods can't get delivered quickly enough to free up those trucks & ships for more deliveries.

It's a type of economic perfect storm: High Demand + A Lot of Money in Circulation + A Restricted Supply of Goods = Higher Prices (Inflation).

With the holiday season approaching quickly approaching and both consumer and corporate confidence already slowing, supply shortages and shipping delays could have a major impact on earnings, not only in 4Q21but also for any potential capital expenditures in 2022 and beyond.

Want More Information?

Contact us for more information on how this may affect your portfolio, or schedule a call to discuss your situation more in depth.