federal reserve

Blog tagged as federal reserve

"When Someone Tells You Who they Are, Believe Them the First Time" - Maya Angelou

October 18, 2022 02:55 PM - Comment(s)

The Fed, the Treasury bond market, and the VIX are all trying to tell us something...

No New Surprises

September 21, 2022 03:15 PM - Comment(s)

Today's move by the Federal Reserve is no surprise.

Thoughts on Valuations

December 15, 2021 04:04 PM - Comment(s)

Is the market too high or too low? Should I be concerned, or ready to take advantage of opportunities?

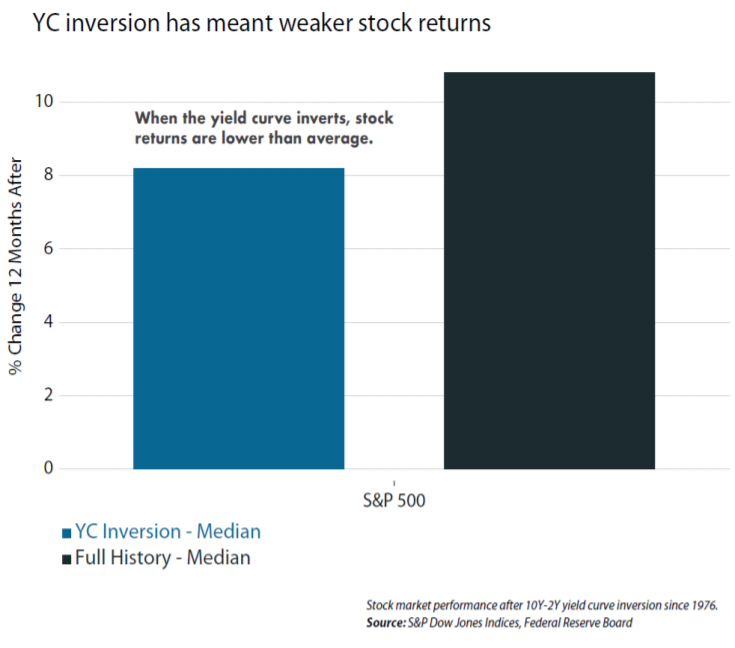

An Inverted Yield Curve Does Not Mean Imminent Recession

September 09, 2019 04:00 PM - Comment(s)

Economic growth and stock returns have been weaker one year later

MAIN POINTS

An inverted yield curve is not a sufficient condition for a U.S. recession.

Tight financial conditions and/or weakness in the services sector would increase recession risk more meaningfully.

Inversion has been followed by inc...

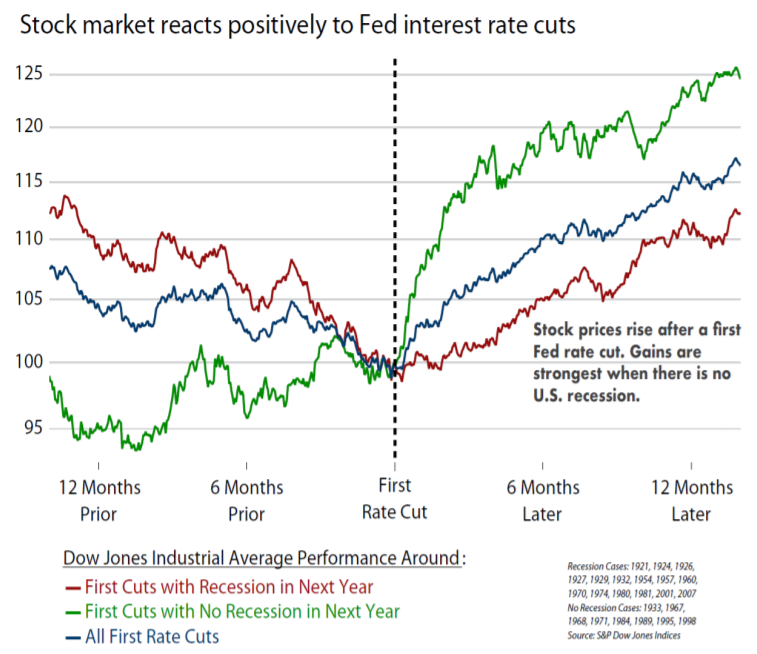

What a Fed Rate Cut Means for the Markets

August 19, 2019 11:35 AM - Comment(s)

Stocks and bonds gain when Fed policy becomes more accomodative.

Main Points:

- U.S. and international stock prices rise after a first Fed rate cut. Gains are strongest when there is no U.S. recession.

- Bond prices consistently rise prior to an initial rate cut, but are stagnant afterwards.

- Rate cuts can h...

Categories

- Uncategorized

(10)

- Economy

(27)

- Financial Services Industry

(2)

- Politics

(6)

- Trends

(3)

- Markets

(9)