In my last post, the market had just pulled back about 10% within a few days. Since then, the market not only declined about 34% from its late February peak, it also recovered just over 30% from the bottom. This market reminds me of two very famous lines from "The Godfa...

LWM Blog

Coronavirus and Market Thoughts

A few thoughts on the market volatility the last few days...

The coronavirus will have an impact for an undetermined amount of time, especially until the source is found and largely due to the lack of a defined treatment/vaccine. That uncertainty and amplification from the news cycle make this curren...

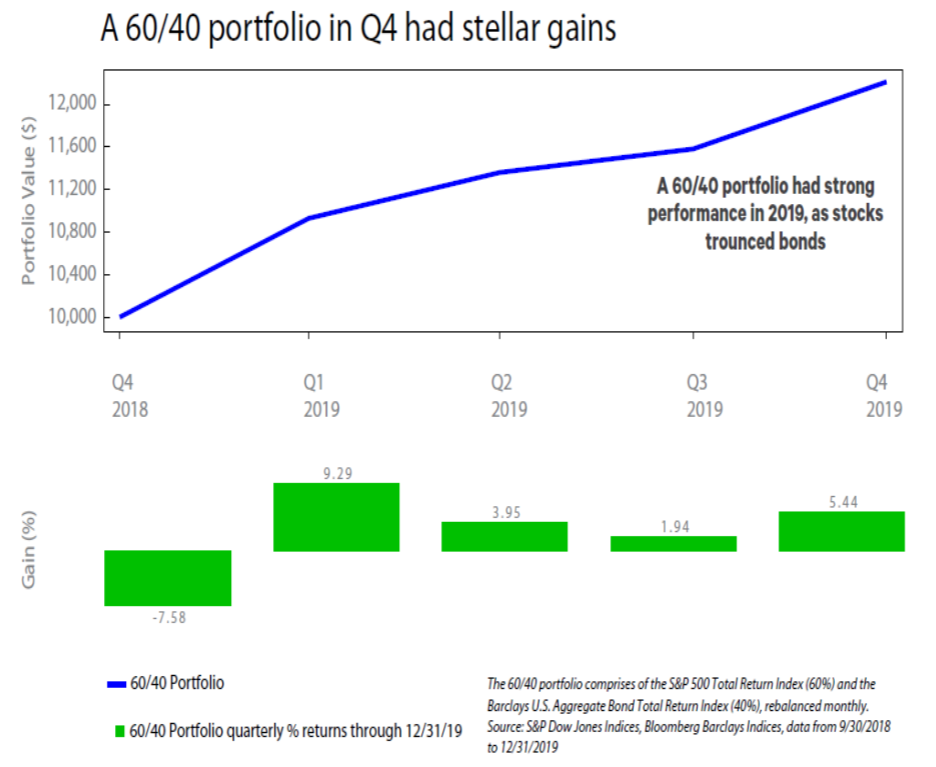

2019 Finishes With a Bang

Stocks trounce bonds with double-digit gains

MAIN POINTS

Stock markets around the world rallied strongly in 2019. Returns likely to be more normal in 2020.

Bonds rallied for the first three quarters due to global and trade uncertainty, but dropped in Q4.

Election uncertianty and high optimism and risks ...

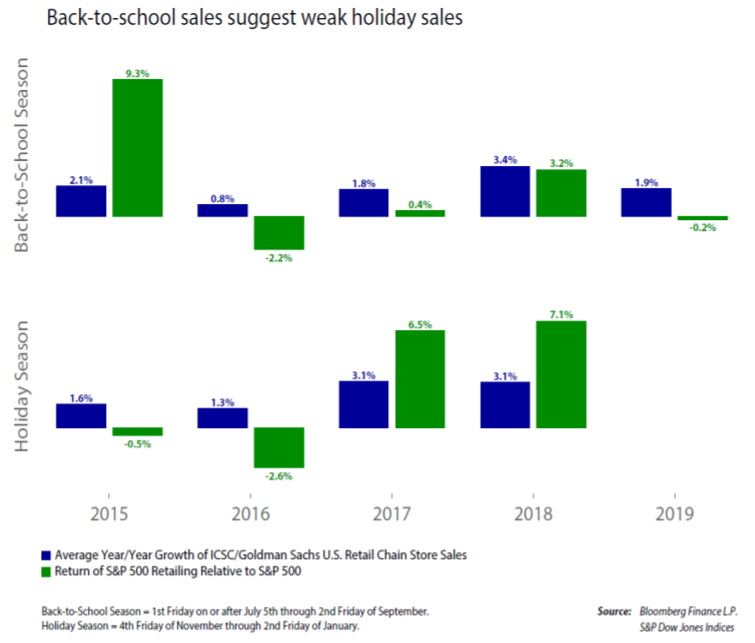

Will this be a Jolly Holiday Season?

Back-to-school sales suggest holiday sales growth is at risk.

MAIN POINTS

Retail stocks typically underperform in December.

Tariffs and projected weak holiday sales growth are additional risks for Retailing.

While internet sales continue to take share from department stores, even companies like Amazon a...

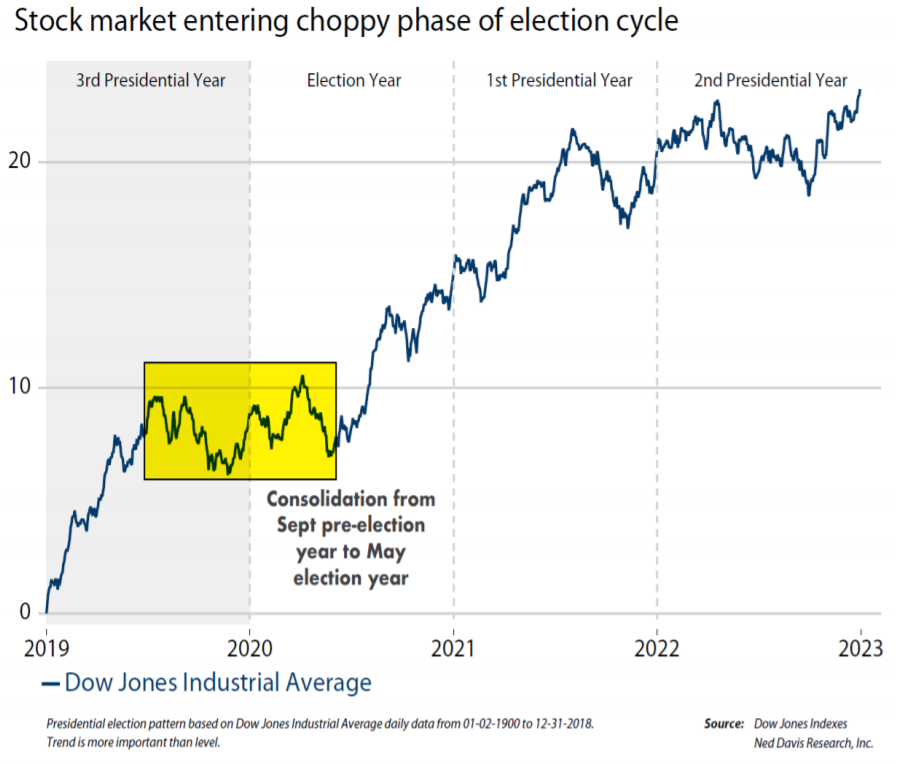

Presidential Cycle Choppy into Mid-2020

Consolidation typically starts now and ends in May

MAIN POINTS

In the first half of 2020, the risk for a political overhang to the stock market is high.

Near-term risks continue to include earnings expectations and the trade war with China.

Once a presidential winner has been identified, the market has ...

Categories

- Uncategorized

(10)

- Economy

(26)

- Financial Services Industry

(2)

- Politics

(6)

- Trends

(3)

- Markets

(9)